Users of Mobile Banking increasing at lightning speed, arbitrary in fees

NepalPress

NepalPress

KATHMANDU: With the spread of mobile and internet in Nepal, the number of mobile banking users is increasing day by day. This has relieved the consumers from the hassle of having to wait in long lines at the banks. However, dissatisfaction with service delivery and high fees is growing.

Although there is no charge for transferring money within the network of the same bank, money is deducted from the consumer’s account when sending money from one bank to another. Consumers are complaining that the deduction fee is very expensive. With the proliferation of mobile banking, which has the largest number of users in banking services, the second-largest number of transactions and the third-largest payment system, the bank operator has not paid attention to making it convenient.

Up to Rs. 1 lakh can be transferred daily through mobile based on the regulation of NRB. Most of the commercial banks in Nepal charge Rs 10 to Rs 75 for transferring money through mobile banking. It is found that Rs 10 is charged for transferring less than Rs 5,000 and Rs 20 to Rs 75 for sending more than Rs 5,000.

There is no reliable data on how many commercial banks and other companies earn through mobile banking. The number of transactions through mobile banking has increased by 294,899 or 3.52 per cent between November and December this year alone. There were 83 lakh 86 thousand 470 transactions in December and 86 lakh 81 thousand 369 transactions in January. Assuming an average of 8 million transactions per month and 50 per cent of them are interbanking transactions, there are 4 million paid monthly transactions.

As the fee for mobile banking is Rs 10 to Rs 75, consumers are spending Rs 1.60 billion monthly on an average of Rs 40. Annually, this amount reaches Rs. 19.20 billion. Of this, 55 per cent or Rs 10.56 billion is taken by the banks including the clearing system of Nabil Bank, while Phone Pay, which is the mediator, takes Rs 8.64 billion. On a monthly basis, banks charge Rs 880 million in mobile banking fees, while PhonePay seems to raise Rs 720 million per month.

In comparison, transactions from Connect IPS and other digital platforms are relatively inexpensive. Connect IPS estimates an average of 1.2 million transactions per month and an average fee of Rs 10 per transaction, earning an average of Rs 12 million per month and Rs 144 million a year.

While transacting with other digital wallets, the fee seems to be decreasing and various cashback offers have also been introduced. Payment through QR codes is free as it is in its infancy and ATM transactions do not generate much revenue.

Consumers have to spend Rs 250 to Rs 300 to bring mobile banking into operation. The same fee is charged for service renewal each year. Banks charge Rs 3.17 billion for the renewal fee of 1,26,89,445 users at a minimum rate of Rs 250 per annum. As the number of mobile banking users increases in the coming days, such income will continue to rise.

Consumers have to spend Rs 250 to Rs 300 to bring mobile banking into operation. The same fee is charged for service renewal each year. Banks charge Rs 3.17 billion for the renewal fee of 1,26,89,445 users at a minimum rate of Rs 250 per annum. As the number of mobile banking users increases in the coming days, such income will continue to rise.

Users adding to lightning speed

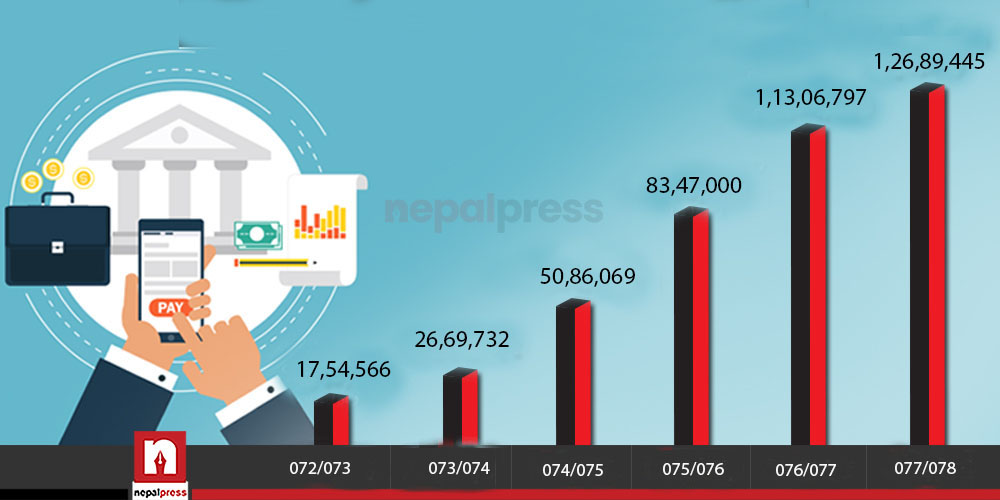

The Payment System Oversight Report 2076/77 released by the Central Bank’s Payment Systems Department shows that the number of mobile banking users is increasing rapidly. According to the report, in the fiscal year 2072/73, 1.754 million people had availed the services of mobile banking. In the next Fiscal Year 2073/74, this number increased by 51.16 per cent and reached 26 lakh 69 thousand 732.

Then in the fiscal year 2074/75, an increase of 90.51 per cent and 5 million 86 thousand 69 people took the facility. In the fiscal year 2075/76, the number of users has increased by 64.12 per cent and reached 8.347 million. The growth rate has increased by 35.46 per cent in the last fiscal year and the number of mobile banking users has reached 11.36 million.

As per the report of January / February of the current Fiscal Year, there are 12.689 million 445 mobile banking users in Nepal. Compared to the first six months of the previous fiscal year, 1.382 million 648 users have been added and 2.46 thousand 644 users have been added as compared to the month of November. There are more users of digital payment system services than mobile banking customers. As of mid-December of the current fiscal year, the number of Internet banking users has reached 1 million 90 thousand 322, users using various wallets including Isewa 7 million 64 thousand 853, Connect IPS users 28 million 80 thousand 96 and David Card users 80 million 49 thousand 59.

Funds worth Rs. 30.51 billion have been transferred from mobile banking in mid-January alone. In comparison, the number of transactions of Connect IPS is only 1.43 million 873, but it can send a lot of money at a low fee and also pays for the purchase and sale of shares, so the turnover is around Rs 100 billion.

From the wallet to mid-December, more than 9.89 million transactions worth Rs 9.65 billion have been transacted. Similarly, Rs 1.24 billion has been paid from 372,176 transactions through QR payment service and Rs 61.60 billion has been transacted from 74.78 million transactions through ATM machines.