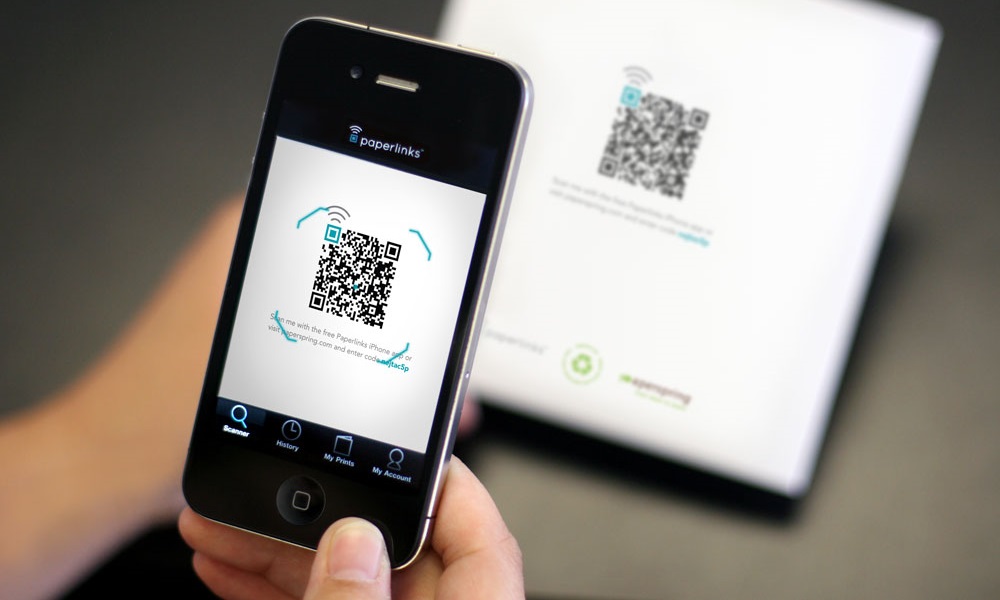

QR codes are everywhere, but how much are they used?

KATHMANDU: With the expansion of information technology, the government has been giving a lot of support to digital payment systems in recent times. QR Code is a digital payment system recently launched by Nepal Rastra Bank itself.

Attempts are being made to expand the QR code payment systems through the initiative of NRB Governor Maha Prasad Adhikari. As a result, signs of QR codes can now be seen from tea shops to vegetable markets. But what is the status of its use? We initially tried to understand this by visiting the Kalimati-based vegetable and fruit market.

The QR code was launched in the presence of Governor Officer and Chief Executive Officer of Prabhu Bank Ashok Sherchan at a function held at the premises of Kalimati Vegetable and Fruit Bazaar on 8th January. At the event, the governor provided QR codes to the traders.

However, QR codes have not been used in the Kalimati market in the days that followed. Some traders said that they had not made QR codes due to the hassle of PAN registration, while others said that even if they made QR codes for themselves, the use was very low.

He said that the implementation of QR code was not practical in the chaos of the Kalimati market.

Not only merchants, but customers also are not as attracted to QR codes. They find it easier to withdraw money from their wallets than to pay using Wi-Fi on their mobile phones. Many people have the mentality of not using banking services to buy goods that cost less, while some customers do not have access to banking.

Keshav Rayamajhi, a customer from Balkhu, says, “In a scenario where it is difficult to make ends meet, who will open a bank account and deposit there?” According to a trader of Kalimati Fruit and Vegetable Market, not even 10 transactions a month have been done through the QR code.

“All customers who pay through QR codes go to the big shopping malls. Why would they come here?” says businessman Rajan Shrestha. “The customers who come here belong to the lower class. Many of them don’t even have a bank account.”

He said that it would not be possible to buy and sell goods in the Kalimati market through QR codes as it is usually very crowded.

“If you come to Kalimati at three in the morning, you will know how much you have to struggle to buy vegetables and fruits. How to use a QR code when it is so difficult just to get the goods? I don’t think the users of QR codes will increase in the Kalimati market, ‘said Shrestha.

Another trader Binod Hamal said that he has not even taken a QR code so far.

“We have not yet taken the QR code as it is mandatory to register a shop and get a PAN card to avail the facility,” he said. “Our store has started the process for PAN card. Prabhu Bank will provide us with the QR code as soon as it arrives,” he said.

However, he said that the number of customers who want to pay through QR codes is very low and most of them want to carry out the transactions in cash.

Some fruit retailers have not found QR code advertisements in front of their shops. They have no idea about the QR code.

Vinay Shrestha, Information Officer of Kalimati Fruits and Vegetables Market Committee, said that various banks including Prabhu Bank are providing QR code facilities in the market.

Free WiFi in the market

Worldlink Communication Pvt. Ltd. has provided free WiFi service in the Kalimati vegetable market. Purchases of vegetables and fruits from the market can be easily made through the QR code of Prabhu Bank and other banks using the Worldlink internet.

Information Officer Shrestha says that so far about 300 traders have taken the QR code. Most of them have taken the QR code of Prabhu Bank.

“Even though our merchants use QR codes, customers are not attracted to them. Since everyone pays in cash, very few users pay through QR codes,” he said.

Prabhu Bank has deployed a team of employees in Kalimati Vegetable Market for traders who want to get QR code.

NRB says users will gradually increase

NRB also admits that traders and customers are less attracted to QR codes. The NRB considers the implementation of QR codes to be challenging due to low income and informal economy, lack of banking access and financial literacy, lack of smartphones and internet for all.

“Despite the challenges, there is no alternative to the digitalisation of transactions,” said Bhuvan Kandel, Executive Director of Nepal Rastra Bank’s payment system department.

“There are many challenges to paying through QR codes. The National Payments Board, formed under the Chairmanship of the Governor to make the payment system digital, will take the necessary decisions and move forward,” he said.

“We believe that users will continue to grow,” he said. He informed that World Link and Vianet are currently providing free internet service to provide required infrastructures, including the internet.

“Banks and financial institutions in Nepal have not charged any fees for payment. Fonepay is also helping us in this,” he said.

What is the payment board doing?

The National Payment Board formed under the Chairmanship of Nepal Rastra Bank has Governor Adhikari, Revenue Secretary of the Ministry of Finance and Chairman of the Telecommunication Authority as its members.

The board takes the initiative to build the necessary infrastructures to increase digital payments. To make the payment system digital, the board has decided to provide QR code to the clients free of cost.

Nepal Rastra Bank has made arrangements to make payments free of additional charges while using QR codes. F1Soft Pvt. Ltd. has provided QR codes to banks while FonePay has been working as a switch.

How is it used?

The QR code can be used through the bank’s mobile banking app. Payment can be made by scanning the QR code of the bank account of the person who needs to be paid through the camera of the payer’s mobile phone. This can be done after clicking on the option of mobile payment once mobile banking services are registered for and a user ID and password are obtained.

The QR code given by the bank to the entrepreneur mentions the account number and name of the entrepreneur.

How many users?

The data of Nepal Rastra Bank has shown that the number of users of QR codes and their use is gradually increasing. The number of transactions done through QR codes in the payment system index of the central bank’s payment system department till February is 535,790.

Rs. 1.71 billion worth of transactions have been made through QR codes.