Budget presents in-depth, objective assessment of economic challenges: Minister Mahat

NepalPress

NepalPress

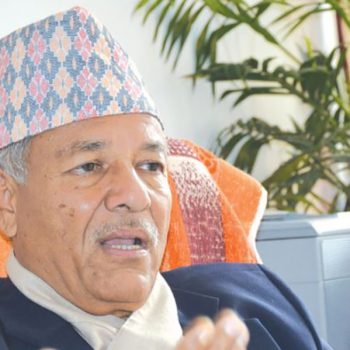

KATHMANDU: Finance Minister Dr Prakash Sharan Mahat has said the budget for the upcoming fiscal year 2023-24 has presented a minute and objective analysis of existing challenges for the economy.

Giving his replies in a meeting of the House of Representatives today over questions raised during the deliberations on the budget that the government presented on May 29, the Minister said the budget was centered on accelerating economic activities and thus addressing the existing economic issues and challenges gradually.

As he claimed, factors discouraging the capital expenditures have been identified and an emphasis has been placed on downsizing public expenditures in the budget. “Announcement for economic reforms, policy improvements to promote private investment and priorities to digital and green economy are some of key points of the budget.”

According to him, through the budget the government laid an emphasis on innovation, production and employment creation. Big infrastructure projects are given continuity, the criteria of revenue collection has been extended and tax rates have been revised, prioritising system reforms in tax administration.

On the occasion, the Minister was of the view of conducting an environmental impact assessment first before operating river-based queries and importing river-based products.

He also said the government made its attempt to make customs duty on electric vehicles practical. Electric vehicles have been classified into five groups and revised tax rates have been imposed accordingly.

As per the revised tax system, 10 percent customs duty shall be charged on e-vehicle up to the capacity of 50 kilowatts, 15 percent customs duty and 10 percent excise duty on vehicle from 50 to 100 kilowatts, 20 percent custom duty and 20 percent excise duty for vehicles from 100 to 200 kilowatts. Likewise, 40 percent customs duty and 45 percent excise duty shall be charged in the import of vehicle from 200 to 300 kilowatts. The customs duty for vehicles above this capacity remains unchanged.

The Minister said tax rates for petroleum vehicles of all capacities is same and only slight changes have been made in the rates of excise duty.

During the replies, he said the accusation on the government that it leaked an information about revises in tax rates in the budget, leading to imports of vehicles on a large scale on the eve of the budget speech kept no meaning.

The trend shows that large imports take place before the budget speech each year. A letter of credit for 90 percent of recently imported 1,300 vehicles was proceeded in March-April, according to him.

He claimed that tax on electric vehicles in Nepal is the least in the entire SAARC, suggesting the government priority to promote electric vehicles. As he mentioned, it is from 35 percent to 100 percent in India, 50 percent in Pakistan and around 90 percent including all taxes in Bangladesh. RSS