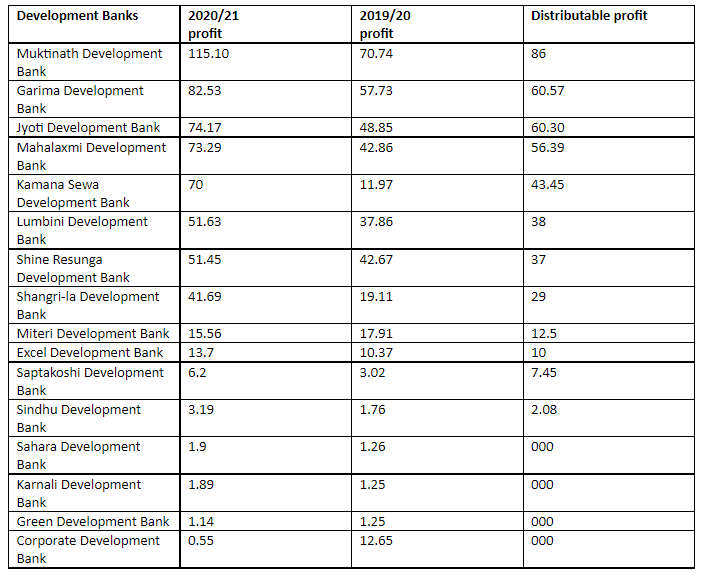

Development banks earned attractive profit than commercial banks

KATHMANDU: The profit of national level Class ‘B’ Development Banks licensed by Nepal Rastra Bank has increased by around 58.23 percent as compared to the fiscal year 2019/20.

As the Covid-19 pandemic has brought the economy to a standstill, Nepal Rastra Bank has increased the limit for provisioning. The development banks have still earned high profits even at low interest rates.

The profit gained by some development banks is more than the national level commercial banks. Their annual report of the last fiscal year showed that the development banks with less capital, investment, manpower and resources than commercial banks have earned good returns and attractive distributable profits.

There are 18 development banks operating at the national and regional level with the permission of Nepal Rastra Bank. Of which 10 are national level and eight are regional level.

There are 17 development banks listed in the Securities Board of Nepal (SEBON). Out of them, 13 development banks have earned good profits while the profits of three development banks have been negative compared to last year.

Out of the commercial banks, Civil Bank has earned less profit of Rs 560 million in the fiscal year 2020/21. Five development banks including Muktinath Development Bank, Garima Development Bank, Jyoti Development Bank, Mahalakshmi Development Bank and Kamana Development Bank have surpassed Civil Bank in profit.

Lumbini Development Bank and Shine Resunga Development Bank have earned an average profit similar to Civil Bank.

Muktinath Development Bank and Garima Development Bank have managed to make more profit than Century Bank, which earned only Rs 750 million. Jyoti Bikash, Mahalakshmi and Kamana Sewa have earned the same profit as that of commercial banks.

Muktinath Development Bank, on the other hand, has surpassed three commercial banks, Civil Bank, Century and Nepal SBI Bank in terms of profits.

Meanwhile, the profit of development banks have increased by 58 percent in comparison to the fiscal year 2019/20. The banks had generated the profit of Rs 3.81 billion in the fiscal year 2019/20 while the profit was earned by Rs 6.2 billion in the fiscal year 2020/21. Out of this Rs 4.21 billion is the distributable profit.

Development banks have a paid-up capital of around Rs 33 billion. The development banks’ average earnings per share is 13 percent. The other average EPS has been found good if the 8.23 negative earning per share (EPS) of Narayani Development Bank is removed out of this. Meanwhile, the profit of development banks have increased by 58 percent in comparison to the fiscal year 2019/20. The banks had generated a profit of Rs 3.81 billion in the fiscal year 2019/20 while the profit was earned by Rs 6.2 billion in the fiscal year 2020/21. Out of this Rs 4.21 billion is the distributable profit.

Kamana Development Bank has 26.4 percent, Muktinath Development Bank has about 24 percent, Garima Development Bank has 22.5 percent, Mahalakshmi Development Bank has about 22 percent, Miteri Development Bank has 19.5 percent and Jyoti Development Bank has 19.3 percent are the banks with high earnings per share.

Muktinath Development Bank had earned the highest profit of Rs 1.15 billion in the fiscal year 2020/21. The bank had gained a profit of Rs 707.4 million in the fiscal year 2020/21, an increase of about 63 percent. Garima Development Bank is the second most profitable bank in the country. It has earned a profit of Rs 825.3 million in the fiscal year 2020/21, which is about 43 percent more than the last fiscal year.

Jyoti Vikas Bank is the third bank to earn the highest profit. It has earned a profit of Rs 740 million in the fiscal year 2019/20. Similarly, Kamana Development Bank has generated a profit of Rs 120 million in the last fiscal year while the bank has earned a profit of Rs 700 million in the fiscal year 2020/21.

The 27 commercial banks had earned a profit of Rs 63.37 billion in the fiscal year 2020/21, an increase of about 20 percent, in comparison to the fiscal year 2019/20. The distributable profit of commercial banks is Rs 46.56 billion.